Under the Digital Business Plan, the government will mandate e-Invoicing for all agencies by Jand when you submit an e-invoice under $1 million, you'll be paid within 5 days To summarise the benefits of e-Invoicing. If you deal with Australian government agencies there's an additional reason to implement e-invoicing. And it will reduce your time entering and processing supplier invoices in your accounts, saving you money You will never be told again - 'I never got your invoice'. Since e-invoices are sent directly between the accounting systems of each business, you know that your customers have your invoice ready to be approved and paid - improving your cashflow. These manual steps can create delays in invoices being processed which can impact your cashflow In both scenarios, there is some manual data entry required that is time consuming and can lead to human errors such as entering the wrong invoice amount, the wrong bank account, or sending the invoice to the wrong person. Meaning that you then scan or manually enter the supplier invoice into your accounting software

When working with suppliers, invoices for good or services provided are sent to you. Which they then enter in their accounting software ( or keep a copy of to give to their bookkeeper at BAS time, and accountant at tax time) When making a sale, often a tax invoice is raised and either emailed to the customer or printed and provided as a physical document. The tax office have no visibility over the networkĬurrently, managing invoices for a business happens at two points in the accounting process - as a part of sales with your customers, and as a part of expenses with your suppliers While the ATO are the champions of e-Invoicing in Australia, invoices are sent securely over the network and the only people that can see those invoices are your accounting platform, you, and the other party to the invoice ( whether they are a customer or supplier). Being a global framework, it helps support international trade and creates new business opportunities for Australian businesses into the future This framework is used globally, to standardise how electronic business documents are shared between businesses in different countries. In Australia, the standard used for e-invoicing is called PEPPOL - which originated in Europe and stands for Pan-European Public Procurement OnLine. With e-invoicing, businesses no longer need to provide paper based (or PDF) invoices as a record of sale, and customers no longer need to enter invoices into their accounting system - the process is completely digital, automated, and takes place over an open network

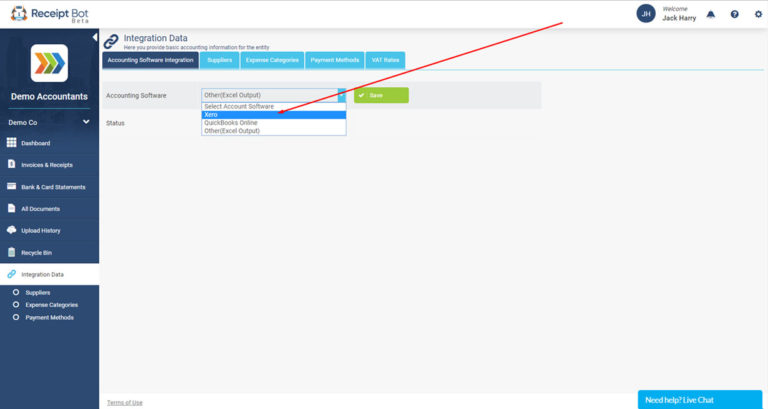

#Xero accounting software manual pdf how to

In this article we explore what is electronic invoicing (or e-invoicing), how to send e-Invoices in Xero, and what are the benefits for your businessĮlectronic invoicing (or e-invoicing) is the direct digital exchange of invoice information between the accounting systems of a customer and a supplier. It's a new digital invoicing framework designed to automate many of the sticking points that currently get in the way of small businesses being paid. If you've ever chased up a small business customer asking for payment only to hear the excuse - ' I never got your invoice, can you resend it', you might want to check out e-invoicing.

0 kommentar(er)

0 kommentar(er)